Illinois Government 101: Understanding Your State Legislature

Illinois has bicameral legislature, which means it’s made up of two chambers:

- 59 State Senate districts

- 118 State House districts

Each Senate district elects one Senator, and each is divided into two House districts, which each elect one Representative. Together, these 177 legislators shape laws, set the state budget, and work to represent the needs of their local communities.

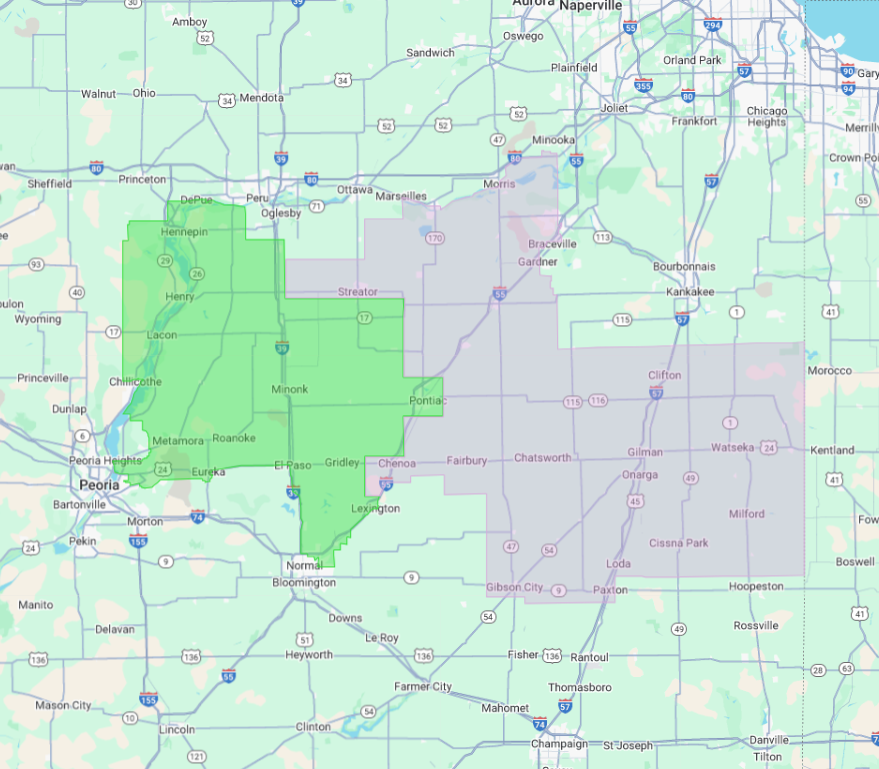

You can view a map of our district here. You can see that it is divided into two colors. Representative Jason R. Bunting represents the 106th District, which is what you see on the right, and Representative Dennis Tipsword represents the 105th District, which is what you see on the left. These two House districts make up the 53rd Senate district, which is what I represent. Want to know how an idea becomes law in Illinois?

Check out this helpful guide from the Illinois General Assembly:

🔗 How a Bill Becomes Law in Illinois (ilga.gov)

Upcoming County Fairs

County Fairs are always a highlight of Summer Fun for our families! In Northern Illinois, we are blessed to have some of the best county fairs in the state.

These fairs are possible thanks to the dedicated volunteers who work tirelessly throughout the year to make them a memorable experience for our families.

Looking for summer fun? See which county fairs are coming to your area!

- Iroquois County Fair: Tuesday July 15 – Sunday July 20

- Peoria County Fair: Tuesday July 15 – Saturday July 19

- Marshall-Putnam Fair: Wednesday July 16 – Sunday July 20

- Livingston County Fair: Wednesday July 16 – Sunday July 20

Illinois Breaks Revenue Record but Taxpayers Still Face Higher Bills

Illinois families are already feeling the pinch of higher prices, yet state government continues to grow at a rapid pace. This year, lawmakers passed the largest budget in state history, despite record revenues totaling $54 billion. The new spending plan includes nearly $1 billion in additional taxes, along with short-term budget maneuvers that raise serious concerns about the long-term stability of our state’s finances.

Over the past six years, state spending has increased by nearly 40 percent. Meanwhile, working families are doing everything they can to stretch their paychecks and keep up with the rising cost of living.

During the spring session, a number of concerning tax proposals were discussed —everything from a $1.50 delivery tax that would’ve affected groceries and baby formula, to new taxes on essential services like car repairs, haircuts, and small business advertising. Thankfully, those proposals didn’t make it into the final budget, but they remain on the table for future consideration. One of my main priorities is to grow the Gross Domestic Product of Illinois, which is already the 6th highest in the nation at $1.1 trillion. We have so many natural resources, and we have a prime geographical location. If we couple that with the skills and talents of 13 million Illinoisians, we will create a winning recipe that allows for the tremendous growth of large and small businesses! I am leading the charge to reduce burdensome regulations and to get the government out of the way so that capitalism can work.

IDOR Urges Late Tax Filers to Act Now

The Illinois Department of Revenue (IDOR) is reminding taxpayers who missed the April 15, 2025, deadline that there’s still time to file—and that filing promptly can help lower any penalties and interest owed.

Illinois grants an automatic six-month extension to file individual income tax returns, moving the deadline to October 15, 2025. However, this does not extend the time to pay taxes owed. Taxpayers expecting to owe must submit payment using Form IL-505-I (Automatic Extension Payment for Individuals) to avoid penalties on unpaid balances not paid by April 15, 2025.

To avoid future filing issues, IDOR recommends:

- Filing electronically through MyTax Illinois

- Using direct deposit or debit for faster processing

- Setting reminders and signing up for email updates at tax.illinois.gov

For more information, visit tax.illinois.gov.